Financial Resources

Sponsored by: Key Bank

First Steps

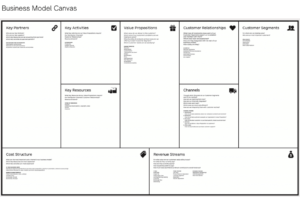

Business Model Canvas

The Business Model Canvas is an excellent tool to create a business model and present your ideas. It gives a clear picture of how you will make money and sustain your business. The Business Model Canvas will challenge you by making you answer tough questions about your business which would help you to be more prepared to start a business.

Business Plan

General Information

The most basic reason for preparing a written business plan is to communicate to others that the operational and financial success of the business is feasible. The plan demonstrates how resources, representing all operational aspects of the business, will interact to make it possible for you to achieve your goals.

• Owner’s Operating Guide. For a start-up business, the plan acts as the guide to make sure you’ve accounted for every aspect of the business and contingency. The plan forces you to lay out a framework for making consistent and rational decisions which further the company’s mission.

• Financing/Investment Proposal. The plan presents an overview of the company’s operating and financial condition, as well as a projection of the company’s future activity, with the intention of garnering interest and justifying outside financing for the business.

• General Sales Tool. The plan can substantiate the claims you make to prospective suppliers, customers and employees.

Goal Setting

Specifically, goals are what you want to accomplish with an expected deadline. Goals should be measurable whenever possible. Sales achieved is one example, but they can also be expressed as hiring projections or achieving personal satisfaction. Goals are not achieved without setting objectives, or the means of reaching them, with practical timetables for doing so.

Resources

From a practical point of view, a plan identifies the resources, such as capital, personnel, equipment, machinery, inventory, supplies and facilities required to execute the plan.

Managing Change

A plan can address how you handle changes in your external or internal environments. Such changes might include new competitors, industry price decreases, loss of key personnel and so forth. The plan should anticipate problems and present strategies for avoiding, minimizing and managing them.

Business Introduction Section

Provide a history and description of the business

How and why did you (or why do you want to) get into this type of business?

Mission Statement

Who are you and what do you do?

What services do you offer?

Whom do you serve?

Research Market Feasibility

Is there a need for your products and services in the area where your business is located?

How much of a need is there and how much of it will you serve?

Competition

Who is your competition?

What services do they offer; what are their strengths and weaknesses?

Are they a threat to your business

Industry Trends

What does the industry look like at this time: Is it stable or declining?

Potential Market

Given what is known about the above issues, what is the potential demand/need for your business?

Business Organization Section

Legal

Will the business be a sole proprietorship, partnership, or corporation?

Will it be a profit-making or non-profit organization?

Will it have a board of directors?

Who will determine the policies and budget?

Insurance

What types of insurance will you carry (liability, fire, theft, health, accident) and through whom?

Tax and bookkeeping system

What records do you need to maintain?

What system will you use?

Regulation, licensing, and/or government issues

What licensing issues are there for your industry?

What are the zoning regulation(s) for your location?

What local building code requirements must you adhere to?

Management/Operations Section

Personnel/management team

Who are they?

What are their qualifications?

What education have they had?

Are they competent, capable, and experienced?

Benefits

What benefits are being offered to employees?

Employee requirements and job descriptions

What are your hiring practices?

What is your wage scale?

What are your staffing patterns?

What will specific employees be expected to do?

Business operations

How will you actually run your business?

What are your major business policies?

What is your schedule of daily program activities and how will they provide you with a competitive advantage?

Suppliers

What equipment and materials do you need?

Where will they be obtained?

Provide breakdowns of costs by supplier.

External Partners

Will a lawyer, accountant, or consultant/specialist be used?

Technology needs

Do you need or will you need any technology to help you, such as computers, telephone add-ons, special software, equipment, or communication devices?

Marketing Section

Describe your products and services

What do you offer and to whom?

Do you offer and special services that may not be offered elsewhere?

Describe the target market for your products and services

Who will be served?

Identify your location

Where is your facility located?

Has it met local and state inspections and zoning requirements?

Does it accommodate special needs?

What features about your site are desirable for child care and families?

Pricing Strategies

How will fees be determined?

Will there be late fees, paid holidays and vacations, sick days, etc.?

Will you charge for special services, i.e., transportation/shipping?

Promotional Strategies

How will you reach your customers?

What advertising methods will you use?

Financial Section

Start-up costs

If applicable, what will you need to purchase to begin?

What operating funds will be needed?

Where will this money be obtained?

How much, totally, is needed to successfully cover al start-up costs?

Cash-flow projection

Where will your income come from and where will it go?

Anticipate your income and expenses for a two year period, month by month and by year.

Projected income statements

Three years; first year broken down monthly, second and third year quarterly or annually.

Can you make a profit?

Projected balance sheets

Assets, liabilities, net worth?

Three years is preferable.

Financing plan

Will you need to borrow money? How much?

How will you use it and how will it be repaid?

Identify sources of funds

Determine how the program will be funded.

Will you seek a bank loan?

How much money can you provide? (SBA and most banks require you to inject a minimum of 20% of the overall project cost.)

Supporting Documents Section

- Personal Resume(s)

- Letters of Reference

- Job Descriptions

- Contracts, Leases, Licenses to operate business

- Client Lists

Limited Liability Company Versus Sole Proprietor

Which formation is right for you?

General Information

There are many legal ways to structure your business including S Corporations or C Corporations, but the most common two are Limited Liability Companies, and Sole Proprietorships. There are advantages and disadvantages to each and a proper understanding of the legal and financial ramifications will help you decide what is best for you.

A sole proprietor is generally a small business with no employees. It is the easiest and least expensive to form. As a “passthrough” business, your income passes through to your personal tax return. A sole proprietor is an unincorporated business owned and run by one individual with no distinction between the business and the owner. You are entitled to all profits and are responsible for all your business’s debts, losses and liabilities.

Unlike a sole proprietorship, an LLC is a hybrid of a partnership and a corporation and it allows the liability protection of a corporation while providing the tax advantages of a partnership. An LLC is also a “passthrough” business on your personal taxes.

Considerations to Consider

What considerations should you consider when deciding the best structure for you?

- Legal liability. To what extent do you as owner want to be shielded from liability?

- Tax implications. Which business structure offers the best tax minimization?

- Cost of formation and ongoing record keeping.

- Future needs. Will you need financing? Do you want to create a new credit record for your business?

Understanding the key advantages and disadvantages of an LLC compared to a sole proprietor will help you to make the best decisions.

Sole Proprietor Advantages

- No annual paperwork.

- No annual state filing.

- Quick and inexpensive to form.

- All profits/losses are passed through to the owner’s personal tax return and you are only responsible for paying personal federal, state, local and Federal Insurance Contributions Act (FICA) taxes. You are not required to pay any specific business taxes or unemployment taxes.

- You enjoy tax benefits of being self-employed.

Sole Proprietor Disadvantages:

- Sole proprietor uses your social security number and this means your credit is not separate from your business credit. This can make it difficult to obtain funding and to build business credit.

- There’s no liability protection against commercial debts, law suits and obligations of the business.

- Legally a sole proprietor can hire employees by obtaining an EIN, however in doing so you may put yourself at risk. If you face legal issues related to an employee, you could be putting your personal assets at risk if you operate as a sole proprietor.

LLC Advantages

- A member’s liability is limited to the amount of their investment in the LLC. A member cannot be held personally liable for the debts or obligations of the LLC. You can have a single member or multiple members.

- Forming an LLC separates your personal assets from lawsuits and creditors. When you form an LLC, you are creating a business entity separate from yourself.

- You have a higher degree of market credibility with an LLC compared to a sole proprietor.

- Because your LLC has a separate and distinct Employee Identification Number (EIN) you can build business credit much easier and establish your business with a separate credit score.

- You still enjoy all the tax benefits of being self-employed.

LLC Disadvantages

- Increased paperwork compared to a sole proprietor including any industry specific licensing.

- Annual state filings required

- Additional taxes such as a state business tax or unemployment taxes

- Costs for forming and completing a tax return for an LLC are higher than those of forming a sole proprietor.

Resources

If you are an entrepreneur looking to start a new business this is an exciting time for you. Knowing the proper way to legally form your business will be an important first step. The Duquesne University SBDC has knowledgeable consultants at no charge, who can assist you with your business planning needs. This includes assistance in legally forming and structuring your business. Call us today for an initial consultation.

Minority-owned Small Businesses

General Information

Minority-owned small business information center includes resources, information, and links to assist minorities with starting or growing their small business. The Minority Business Development Agency recognizes minority-owned businesses as those owned by African Americans, Hispanics, Asians, and Pacific Islanders, or American Indians and Alaska Natives. The most recent U.S. Business Fact Sheets from the MBDA indicates that there are about 8 million minority-owned businesses, or about 29% of all U.S. businesses.

You can also receive free professional business advice and free or low-cost training from your local Small Business Development Center!

Federal Resources for Minority-Owned Small Business

Minority Business Development Agency – part of the U.S. Department of Commerce, specifically created to encourage the creation, growth, and expansion of minority- owned businesses in the United States.

8(a) Business Development program – program to help provide a level playing field for small businesses owned by socially and economically disadvantaged people or entities

Office of Indian Energy and Economic Development – government agency focused on helping Indian communities gain economic self-sufficiency through the development of their energy and mineral resources, application of established business practices, and co-sponsorship of innovative training programs

Minority-Owned Small Business Associations and Organizations

Latin Business Association – provides resources to promote the growth of the Latino business community

Minority Enterprise Development Corp. – a partnership of public, private and nonprofit agencies supporting minority business leaders

The National Black Chamber of Commerce – representing 95,000 Black-owned businesses and 190 affiliates in the United States and internationally

The National Minority Business Council, Inc. – provides business assistance, educational opportunities, seminars, purchasing listings and related services to

National Minority Supplier Development Council – advances business opportunities for certified minority business enterprises and connects them to corporate members

U.S. Pan Asian American Chamber of Commerce – organization representing Pan Asian American and their related groups in business, sciences, the arts, sports, education, public and community services

U.S. Black Chambers, Inc. – provides advocacy, access to capital, contracting opportunities, training and development

U.S. Hispanic Chamber of Commerce – provides business partnerships, through dialogue, networking, workshops, and more for Hispanic Owned businesses

Financial Resources for Minority-Owned Small Business

ACCION – microfinance organization that supports Hispanic businesses, among other minority-owned businesses, through micro-loans of up to $50,000 and financial education

Grants and Loans – business consulting, procurement matching and financial assistance to minority-owned firms

First Nations Development Institute Grants – improves economic conditions for Native Americans through direct financial grants, technical assistance & training, and advocacy & policy

Minority-Owned Businesses – what you need know to get certified and take advantage of the grants, loans, and government programs specifically designed to help minority- owned businesses

SBA’s grant programs generally support non-profit organizations, intermediary lending institutions, and state and local governments in an effort to expand and enhance small business technical and financial assistance. Other federal grant programs generally support non-profit organizations, and state and local governments and are not given directly to small businesses. A list of Federal Grant programs can be found on SBA’s web site at: SBA Federal Grant Resources.

Unfortunately, some unscrupulous operators sell manuals, workshops and other materials on how to obtain “free money.” To find out how to avoid these scams, see the Federal Trade

Commission’s article about wealth building scams.

Other Resources for Minority-Owned Small Businesses

Black Enterprise – business news, educational tools, and minority business trends

Making It TV – information pertaining to minority enterprises

Minority Business Entrepreneur – serves as a forum for minority and women business owners, corporations and government agencies concerned with minority and women business enterprise development

Operation Hope Small-Business Empowerment Program – intensive course, anchored by entrepreneurship training, allows participants to master business basics and gain access to funding to support a strong launch and the ongoing growth of their businesses

Hispanic Network – a Latino business & employment magazine

Latin Biz Today – resources on starting and growing a business directed at Hispanic business owners

The Asian Entrepreneur –digital publication and information exchange with content from Asian entrepreneur in the U.S. and Asia

Native Business – promoting and advancing Native American business, entrepreneurship and economic development

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more small business help topics here: Small Business Information Center

- View business reports here: Small Business Snapshots

- View industry-specific research here: Market Research Links

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo credit: Photo by Christina Morillo on Pexels.

Women-owned Small Businesses

General Information

Women-owned small business information center that includes resources, information and links to assist women with starting or growing their small business. According to The 2018 State of Women-Owned Businesses Report conducted by American Express, there are 12.3 million women-owned businesses, or about 40% of all small business in America.

You can also receive free professional business advice and free or low-cost training from your local Small Business Development Center!

Federal Resources for Women-Owned Small Businesses

Women and Small Business – resources, programs and guides dedicated to helping women entrepreneurs from the SBA

Women-Owned Small Business Federal Contracting Program – government contracts for industries where women-owned small businesses are underrepresented

Contracts for Women-Owned Small Businesses – eligibility requirements, checklist and guidance from the GSA to take advantage of women-owned small business programs

Women’s Business Center – directory of 122 Women’s Business Centers throughout the U.S., funded by the SBA and offering small business assistance to women entrepreneurs

Women-Owned Small Business Associations and Organizations

American Business Woman’s Association – provides opportunities for women to grow through leadership, education, networking support, and national recognition

Awesome Women Entrepreneurs – national organization for female professionals to connect to one another in and connect with fellow businesswomen about business and daily entrepreneur life

The BOSS Network – female empowerment alliance dedicated to highlighting women and creating opportunities for growth

Catalyst – non-profit membership organization building inclusive workplaces and expand opportunities for women in business

The Committee of 200 – advances women’s leadership in business by offering current leaders access to unique programming as well as a professional and personal network of peers

Female Founders Alliance – organization that focuses on accelerating venture-scale female founded companies

Lean In – one of the largest networks for helping women find their niche and build their strengths in a variety of disciplines

National Association of Negro Business and Professional Women’s Clubs, Inc. – promotes and protects the interests of African-American women business owners and professionals through community service and social activism

National Association of Women Business Owners – advises on issues of impact and importance to women entrepreneurs and business owners

National Women’s Business Council – federal advisory council created to serve as an independent source of advice and policy recommendations on economic issues of importance to women business owners.

National Women Business Owners Corporation – certifier of WBEs and provides national certification for women and veteran-owned companies

Women’s Business Enterprise National Council – provides access to a national standard of certification and provides information on certified women’s businesses to purchasing managers through an Internet database

Women’s Business Exchange – organization providing networking, professional education, leadership training, mentoring, and exposure to community issues

Women Construction Owners & Executives USA – organization that promotes the growth of female owners and executives in the construction industry through publicity, education, advocacy, and business services

Women in Technology International – mission to empower women worldwide through technology

Women Presidents’ Organization – non-profit membership organization for women presidents of multimillion-dollar companies

U.S. Women’s Chamber of Commerce – independent organization that provides resources and advocacy for women business owners

Financial Resources for Women-Owned Small Businesses

Grants for Women-Owned Small Business

Grants for Women Business Owners – guide from American Express on finding and applying to grants

Grants for Women – listing of opportunities for women across industries Amber Grant – grants for women entrepreneurs launched by WomensNet

Cartier Women’s Initiative – grants for women entrepreneurs heading companies with significant potential growth

Eileen Fisher – grants for women with focus in the areas of environmental justice & local communities

Girl Boss – biannual grant for female entrepreneurs pursuing creative endeavors

Halstead Grant – grants for emerging silver jewelry artists

Open Meadows – grants designed and implemented by women and girls that promote gender, racial, and economic justice

SBA’s grant programs generally support non-profit organizations, intermediary lending institutions, and state and local governments in an effort to expand and enhance small business technical and financial assistance. Some specialized federal grant programs, particularly in STEM fields, provide assistance directly to small businesses. A list of government grants and other funding programs can be found on SBA’s web site at: SBA Funding Programs.

Unfortunately, some unscrupulous operators sell manuals, workshops and other materials on how to obtain “free money.” To find out how to avoid these scams, see the Federal Trade

Commission’s article about wealth building scams.

Other Financial Resources for Women-Owned Small Business

37 Angels – community of angel investors created by women with a focus on women owned businesses

Ready Set Raise – national startup accelerator created by and for women

Women’s Venture Fund – helps women build businesses in urban communities offering mentorship, one-on-one classes and small business loans

Womensphere Venture Incubator – incubator designed to help women in science, technology, engineering or mathematics startups through in-person events and online educational classes

Other Resources for Women-Owned Business

eWomen Network, Inc. – helping women and their businesses achieve, succeed and thrive in the new economy through a loyal, dedicated community of women-owned businesses, corporate professionals and entrepreneurs

Forbes Women – articles on work, life, balance, career, leadership, relationships, health, style, beauty, and personal finance

Freelance Mom – helps members locate freelance work from home jobs, providing home business ideas, and sharing Internet marketing strategies to help working moms make smart decisions in business

Mompreneur – teaches mom entrepreneurs how to manage time, generate business ideas, balance business and family, and grow their businesses

WomenOwned.com – business tools and resources to help small businesses profit, connect and grow

Women Entrepreneur – online magazine that provides advice from leading female experts

Women in Business – collection of TED Talks on the topic of women in business

Women on Business – news and information women need to be successful in the business

Women Home Business – trending topics pertinent to women entrepreneurs who own or want to start up home-based businesses

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more small business help topics here: Small Business Information Center

- View business reports here: Small Business Snapshots

- View industry-specific research here: Market Research Links

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Want to Learn More About Key Bank?

At KeyBank, we value diversity, are committed to equity and foster inclusion throughout our business, from the teammates we hire and the clients we serve, to the suppliers we use and the communities that welcome us. Every employee is engaged with and committed to our goals.

Reach out today to one of our representatives:

Bradley Wilkins – [email protected] – 724-719-3243

Adrian Fierro – [email protected] – 412-322-8601